The Aspire Credit Card is a popular alternative for those who want to improve their credit while earning incentives and privileges. However, navigating customer service and knowing your card’s features may have a significant impact on your entire experience.

In this post, we’ll look at the most important features of Aspire Credit Card customer care, how to contact them, and how to manage your account effectively.

Aspire Credit Card Customer Service Team Details

| Service | Contact Method | Details |

|---|---|---|

| Customer Service Hotline | Phone | Call 1-855-802-5572, available from 8:00 a.m. to 12:00 a.m. (ET), Monday – Sunday |

| Mailing Address | Aspire Account Services, P.O. Box 105555, Atlanta, GA 30348-5555 | |

| Online Contact Form | Online | Visit the Aspire website and fill out the contact form for support. |

| TTY/TDD for Hearing Impaired | Phone | Dial 7-1-1 and then 1-855-922-5311 for assistance |

Phone Line Available Call Hours

| Day | Working Hours |

|---|---|

| Monday | 8:00 a.m. to 12:00 a.m. (ET) |

| Tuesday | 8:00 a.m. to 12:00 a.m. (ET) |

| Wednesday | 8:00 a.m. to 12:00 a.m. (ET) |

| Thursday | 8:00 a.m. to 12:00 a.m. (ET) |

| Friday | 8:00 a.m. to 12:00 a.m. (ET) |

| Saturday | 8:00 a.m. to 12:00 a.m. (ET) |

| Sunday | 8:00 a.m. to 12:00 a.m. (ET) |

Tips for Managing Your Aspire Credit Card

- Set up Autopay: Automate payments to guarantee they arrive on time, lowering the chance of late penalties. You may pay the whole sum, the minimum, or a predetermined amount monthly.

- Monitor Your Account on a Regular Basis: Check your balance, examine transactions, and track rewards using the Aspire Account Center online or via the mobile app. This allows you to better control your expenditure and spot illegal transactions early.

- Understand the Fee Structure: Familiarize yourself with all related costs, including yearly, account maintenance, and late payment penalties. This understanding may help prevent unexpected expenses.

- Customer Service: Contact Aspire’s customer care if you have any concerns or queries about your account. They provide help for account administration and issue resolution.

- Before accepting a credit line increase, evaluate the accompanying costs and how they may affect your budget.

- Switch to electronic statements to protect your financial data, eliminate paper waste, and get quicker access to your information.

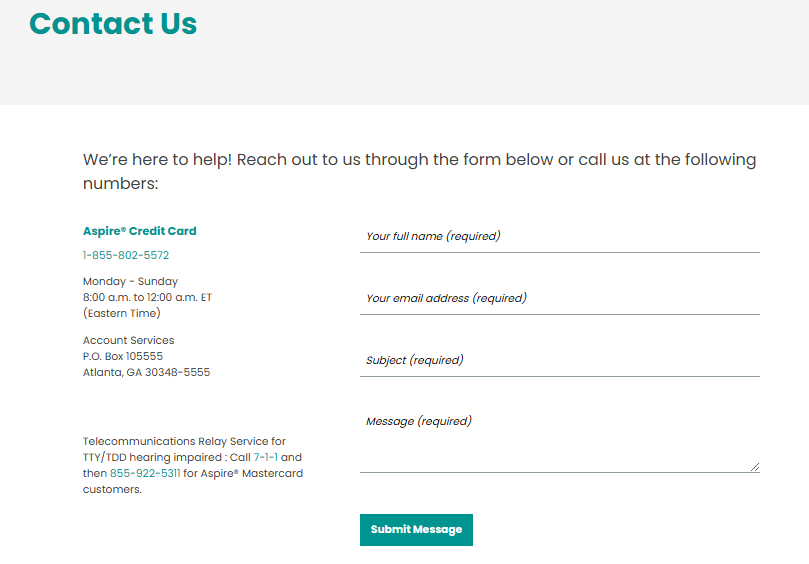

You can fill the form to talk to the Customer Service team

To contact Aspire’s Customer Service team, please use the online contact form on their website. You must include your name, email address, subject line, and a message outlining your question or concern. This direct channel of contact may assist you with any problems or queries you may have about your Aspire Credit Card.

Here’s how to do it:

- Visit the Aspire Credit Card website.

- Scroll down to the Contact Us section.

- Fill in your details such as your Name, Email, and Subject.

- Write your Message explaining the issue or inquiry you have.

- Submit the form to get in touch with the customer service team.

Aspire Credit Card Fees and Terms

The Aspire Credit Card might be expensive owing to its hefty fees. Depending on the card and your creditworthiness, you may pay annual fees ranging from $49 to $175 in the first year, with lower rates subsequently. Furthermore, account maintenance fees and other costs may apply, making this an expensive alternative if not handled wisely.

Conclusion

Aspire Credit Cards provides a variety of services geared to consumers with varying credit requirements, as well as convenient customer service choices. However, prospective users should carefully analyze the related expenses and customer feedback to verify that it meets their financial objectives and expectations.

FAQs

Q1. How do I apply for the Aspire Credit Card?

Ans: You may apply online by going to the Aspire website and completing the prequalification procedure to determine eligibility without damaging your credit score.

Q2. What should I do if I feel there are fraudulent transactions on my Aspire Credit Card?

Ans: Report suspicious activity to Aspire customer care to safeguard your account and prevent illegal transactions.

Q3. How can I raise the credit limit on an Aspire Credit Card?

Ans: To request an increase in your credit limit, use your online account or call customer service. Consider prospective costs and your present creditworthiness.

Q4. Can I use my Aspire Credit Card internationally?

Ans: Aspire Credit Cards are accepted globally anywhere Mastercard is accepted. However, international transaction fees may apply.

Q5. How do I cancel my Aspire Credit Card account?

Ans: To guarantee appropriate closure and confirmation, contact Aspire customer care by phone or via their web form.