If you need to access your Aspire Credit Card account, and www.aspirecreditcard.com acceptance code this article will walk you through the login procedure step by step.

Whether you’re a returning user looking to manage your account or a new cardholder setting up access for the first time, we’ll go over how to safely login in to the Aspire Credit Card gateway. We will also explain how to register your card, manage your account online, and contact customer service if you want help.

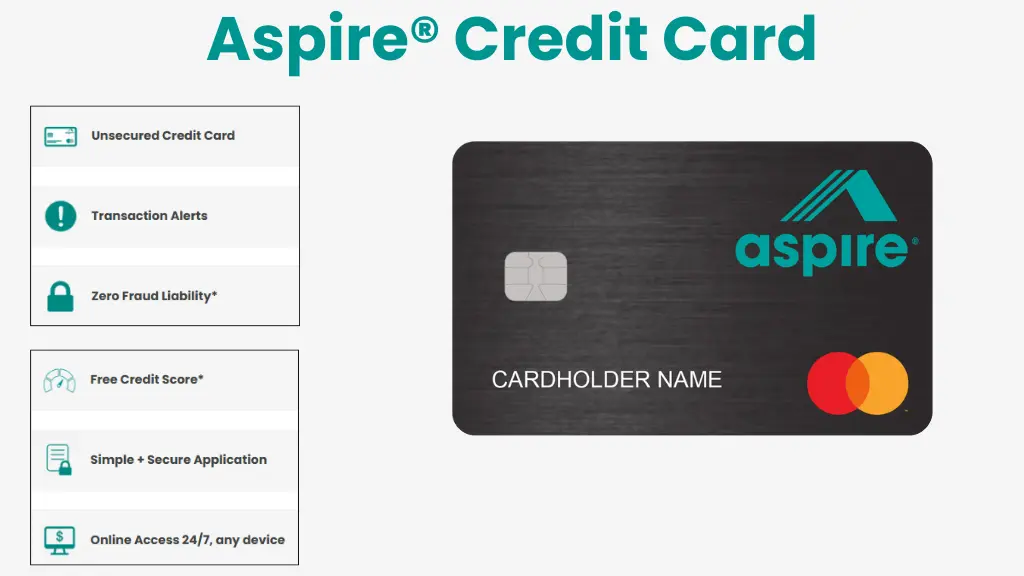

What Is the Aspire Credit Card?

The Aspire Credit Card is a sort of credit card designed for persons looking to establish or rehabilitate their credit. It is an unsecured card, therefore you do not need to pay a security deposit to use it. Aspire records your payments to all three main credit agencies, which can help you improve your credit score over time if used wisely.

AspireCreditCard Overview In 2025

| Card Name | Aspire® Credit Card |

|---|---|

| Provider | Mastercard |

| Online Access | 24/7, any device |

| Credit Score | Free |

| Annual Fee | Starts at $85 |

| Foreign Transaction Fee | 3% |

| Customers Services No. | 855-922-5311 |

| Official Website | www.aspire.com |

The Aspire® Mastercard

You can build credit with the Aspire® Mastercard, an unsecured credit card. It provides free credit ratings, transaction notifications, a straightforward and secure application procedure, no fraud responsibility, and 24-hour online access from any device, assuring simple administration and security.

Requirements for Aspire Credit Card Login

Here are the criteria for logging into your Aspire Credit Card account:

- Registered Account: You must have already registered for online access on the Aspire website.

- Username: Your unique username was created during the registration process.

- Password: The password you created for your Aspire account.

- Secure Device: Use a gadget that fulfills the website’s security requirements.

- Internet Access: A reliable internet connection is required to access the login site.

- Updated Browser: Use an up to date browser that allows for safe online transactions.

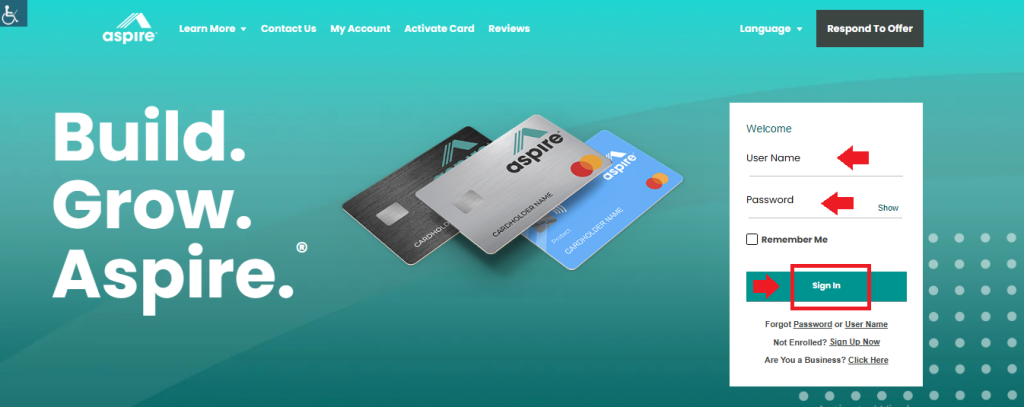

How do I log into my Aspire credit card?

Here’s a simple guide on how to log into your Aspire Credit Card account:

Step 1: Visit the Website:

- Go to the Aspire Credit Card’s official (https://www.aspire.com/) login page.

Step 2: Enter Username:

- Type your registered username into the appropriate field.

Step 3: Enter Password:

- Input your password.

Step 5: Click Login:

- After entering login information then, Press the “Sign In” button to access your account.

Note:- If you don’t currently have an Aspire Credit Card account and need to sign in, you may quickly establish one using the procedures outlined below. This will prepare you to manage your accounts and monitor your expenditures using Aspire.

Troubleshooting Aspire Card Login Issues

If you have trouble getting into your Aspire Credit Card account, try these simple fixes:

- Check your internet connection to ensure it is steady and speedy.

- Check Login Information such as username and password.

- Clear your browser’s cache and cookies, If your browser requires an updated.

- If you need to reset your password, click on the ‘Forgot Password’ page.

- If too many unsuccessful attempts have locked your account, wait a few minutes and try again.

- Still experiencing problems? Please contact Aspire customer service for assistance.

How do I reset my Aspire credit card password & Username?

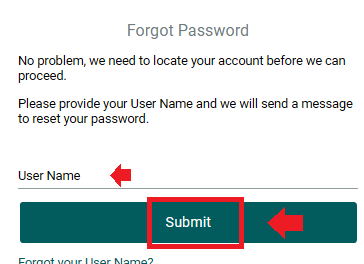

1st:- Reset Password:

- Go to the Aspire credit card login page.

- Click on the ‘Forgot Password‘ link.

- Enter your username associated with your account.

- Check your email for a password reset link sent by Aspire.

- Click on the link in the email and follow the instructions to set a new password.

- Ensure that your new password is strong and secure.

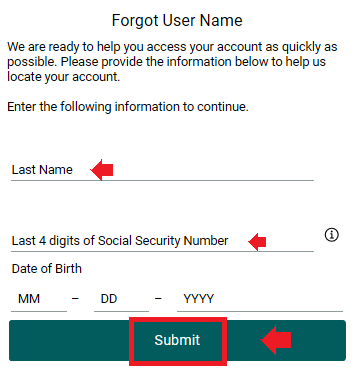

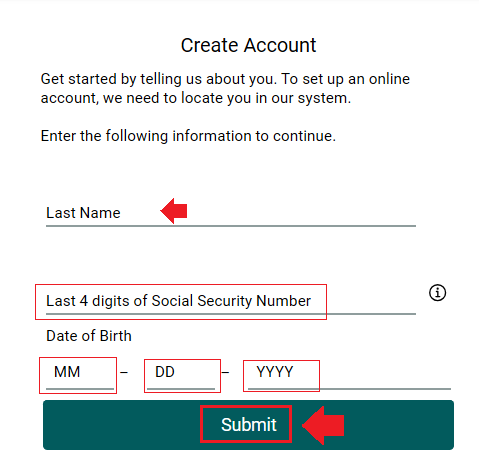

2nd: Chnage Username:

- Go to the Aspire credit card login page.

- Click on the ‘Forgot Username‘ link.

- Enter your Last Name, Last 4 digits SSN in your account.

- After filling all information then, click on the “Submit” button.

- Check your email for a forgot username link sent by Aspire.

- Click on the link in the email and follow the instructions to set a new username.

- Ensure that your new usernameis strong and secure.

How do I Create an Aspire Credit Card Account?

Here’s how to create an Aspire Credit Card account step-by-step:

Step 1: Visit Official Website:

- Go to the Aspire credit card official website.

Step 2: Select Apply Now:

- Find and click the “Sign Up Now” button.

Step 3: Complete Application:

- Enter required information such as your full name, address, Social Security number, employment status, and income details.

Step 4: Submit Application:

- After filling all information then click on the “Submit” button.

Step 5: Wait for Approval:

- Approval could be immediate or take a few days. Wait for notification.

Step 6: Account Setup:

- Once approved, you’ll be prompted to set up your online account for easy management.

Activate Your Aspire® Credit Card Online

Here’s a quick, step bystep tutorial for activating your Aspire® Credit Card online:

- Visit Aspire® Account Center: Visit the Aspire® Account Center to begin activation.

- Sign In: If you already have an account, log in using your username and password to expedite the process.

- Activate Card: After logging in, follow the on screen directions to activate your new credit card.

- Manage Account: Use the Aspire® Account Center to manage your account 24 hours a day, seven days a week, including making payments, setting up notifications, and checking balances.

- Enroll: If you are new to the Aspire® Account Center, choose the enroll option, then finish the procedure and activate your card.

Aspire Card Fees

| Type of Fee | Amount |

|---|---|

| Annual Fee | Starts at $85 (may vary based on card type) |

| Cash Advance Fee | Either $5 or 5% of the amount of each cash advance, whichever is greater |

| Foreign Transaction Fee | 3% of each transaction in U.S. dollars |

| Late Payment Fee | Up to $40 |

| Return Payment Fee | Up to $40 |

| Balance Transfer Fee | 3% of the amount of each transfer |

Fees & APR (Brace yourself):-

- Annual fee: Between $85 and $175 in the first year, depending on credit score; drops to $49 after that.

- Monthly maintenance fee: $0 in the first year, then about $15/month.

- Interest rate: A fixed APR around 36%, sometimes from 29.99–36% depending on your score. Carrying a balance is expensive.

- Balance transfer fee: ~3%; cash advance: 5% (min $10); foreign transaction fee: 3%.

Benefits Of The Aspire Credit Card

Here are some major advantages of the Aspire Credit Card:

- Credit Building: Reports to major credit agencies, allowing users to enhance their credit score via responsible usage.

- Cash Back Rewards: Provides cash back on daily expenditures including petrol, food, and utilities (particular cards required).

- Unsecured Credit: This kind of credit card does not need a security deposit.

- Account Management: You have 24/7 access to the Aspire Account Center to manage your account, check balances, and make payments.

- Fraud Protection: Provides 0% fraud liability to defend against fraudulent transactions.

- Free Credit Score: Get free access to your credit score, enabling you to monitor and manage your credit.

- Flexible Payment Options: Provides a variety of payment alternatives to help you manage your money more easily.

- Customer care: You may contact dedicated customer care for help with any account related difficulties.

Aspire Cash Back Rewards Mastercard 2025

Benefits:

- No security deposit needed – it’s unsecured.

- Pre-qualify without affecting your credit score.

- 3% cash back on gas, groceries, and utilities.

- 1% cash back on all other purchases.

- Reports to all 3 credit bureaus – helps build or rebuild credit.

Fees & Costs:

- Annual fee: $85–$175 (Year 1), then $49 from Year 2.

- Monthly maintenance fee: $0 in Year 1, then $5–$15/month.

- APR: Fixed ~36% – very high if you carry a balance.

- Late fee: Up to $40.

- Foreign transaction fee: 3%.

Things to Know:

- Designed for fair or poor credit (scores ~550–640).

- Typical credit limit: $300–$1,000.

- Rewards are only helpful if you pay in full every month.

- High fees may cancel out cash back if not managed carefully.

- Mixed reviews – some users report account issues and hidden charges.

Aspire Acceptance Code – Key Dates

| Month | Pre-approval Mailing Begins |

|---|---|

| January | Jan 10 |

| April | Apr 8 |

| July | Jul 5 |

| October | Oct 12 |

What is the limit on aspire card?

The credit limit on the Aspire Credit Card varies from $350 to $1,000. This limit is dependent on creditworthiness and may rise over time with responsible usage and frequent account checks by Aspire.

What credit score is needed for an Aspire credit card?

The Aspire Credit Card is primarily aimed toward those with fair to bad credit ratings. This implies that you might be qualified for the card with a credit score as low as 550 to 650. Aspire provides chances for anyone wishing to grow or enhance their credit, making it possible even if they do not have a good credit score.

Important Tips Before You Apply

- Check the interest rate and fees in your offer letter.

- Using the acceptance code doesn’t affect your credit score.

- Only one code is valid per person—don’t share it.

Aspire Card Pros & Cons

| Pros | Cons |

|---|---|

| High rewards rate | High membership fees |

| Bonus rewards categories | High regular APR |

| Qualify with bad credit | Foreign transaction fee |

| Does not require security deposit | – |

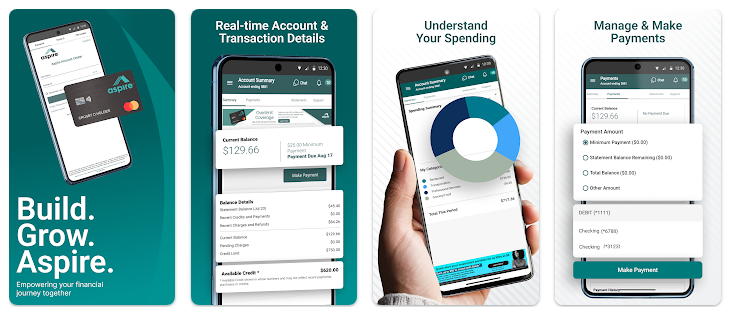

Aspire Download The App

To install and utilize the Aspire app on your phone, just follow these steps: Go to your phone’s App Store or Google Play Store, search for “Aspire Credit Card,” and install the official app with the Aspire logo.

Once installed, use the app and either log in with your current account or create a new one. This software allows you to manage your credit card data, such as checking your balance and making payments, directly from your phone.

| App Store | Download Here |

| Google Play Store | Download Here |

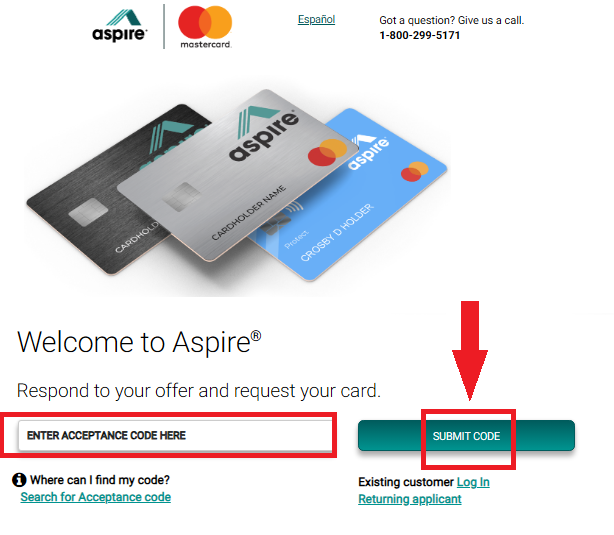

www.aspirecreditcard.com Acceptance Code

To apply for an Aspire® Credit Card with an acceptance code, go to www.aspirecreditcard.com. Enter the acceptance code from your pre approved postal offer to begin the application process. This code streamlines your clearance and setup, resulting in a speedier answer depending on your pre selected eligibility.

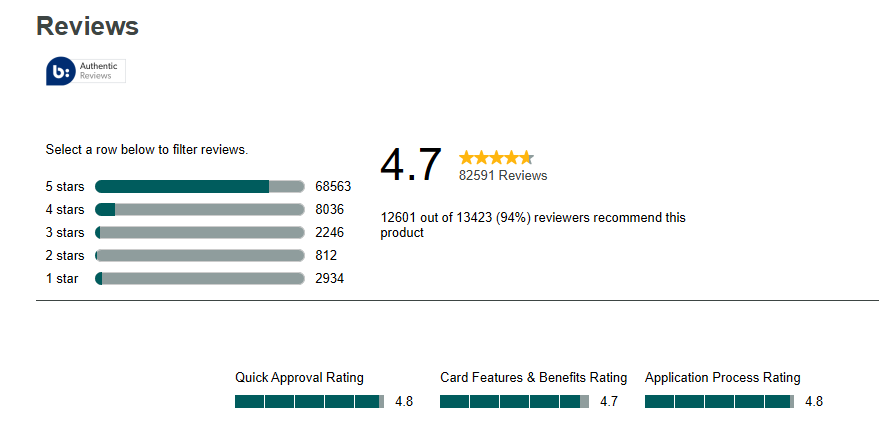

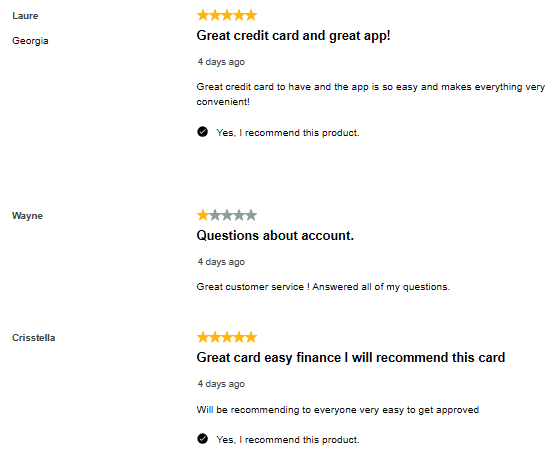

Aspire Credit Card Reviews

The Aspire® Credit Card is known for providing up to 3% cash back on certain categories, such as petrol and groceries, making it an enticing option for daily usage. It is available to persons with poor credit ratings and aims to help with credit development.

However, its high fees and APRs have drawn criticism, potentially making it costly for individuals carrying balances. Furthermore, customer service satisfaction differs per user.

User Aspire Card Reviews:-

Aspire Card Alternative

| Card Type | Card | Benefits |

|---|---|---|

| Aspire® Cash Back Rewards Card |  | Earn 1% cash back rewards on all purchases. |

| Aspire® Protect MasterCard |  | Comes with benefits designed to protect you in unexpected situations. |

Aspire Credit Card Customer Service

| Service | Contact Detail |

|---|---|

| Customer Service Phone Number | 1-855-802-5572 |

| Email Support | [email protected] |

| Online Chat | Available on the Aspire Account Center |

| Call Time | Monday – Sunday 8:00 a.m. to 12:00 a.m. ET (Eastern Time) |

| Postal Address | Account Services P.O. Box 105555 Atlanta, GA 30348-5555 |

Aspire Card Important Link

| Service | Link |

|---|---|

| Apply for Aspire Credit Card | Apply Now |

| Aspire Account Center | Account Login |

| Customer Support | Contact Us |

| FAQs | Frequently Asked Questions |

| Activation of Card | Activate Card |

Conclusion

The Aspire Credit Card may be a great tool for developing credit and managing money, particularly for people who have limited alternatives owing to their credit history. However, the high fees and interest rates need careful financial planning and discipline. Always evaluate comparable credit card offers to guarantee you get the best one for your financial position and objectives.

FAQs

Q1. How does one apply for an Aspire Credit Card?

Ans: You may apply online at the official Aspire website or by replying to a pre approved offer sent in the mail.

Q2. What is the minimum credit score for the Aspire Credit Card?

Ans: The Aspire Credit Card is primarily intended for those with fair to bad credit ratings, often between 550 and 650.

Q3. Can I use the Aspire Credit Card to do overseas transactions?

Ans: Yes, however there is a 3% foreign transaction charge for all overseas purchases.

Q4. How can I check my Aspire Credit Card balance?

Ans: Check your balance with the Aspire Account Center online or the Aspire mobile app.

Q5. What should I do if my Aspire Credit Card is lost or stolen?

Ans: To avoid illegal usage, immediately report the lost or stolen card to Aspire customer care and obtain a replacement.